Emerging Technology Services startups are specialist organizations. They focus on a particular...

Demystifying ETS valuations Part 7: Revenue Predictability

We have already discussed the criticality of Revenue and Revenue Growth. They are primary drivers of valuation in ETS businesses. A related driver is Revenue Predictability, which is a measure of risk associated with the current revenue. High risk revenue is revenue that can go away any time. Low risk revenue is revenue that is unlikely to go away. As ETS startups mature, improving revenue predictability shall be a primary goal both to optimize day to day planning and increasing enterprise value.

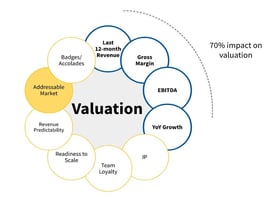

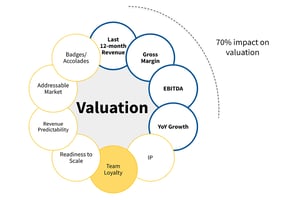

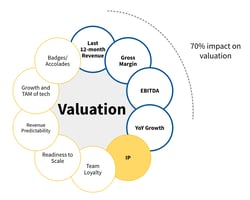

Valuation Drivers

Valuation DriversThere are three types of revenue that you will see in ETS businesses:

-

Recurring revenue – this is revenue where customers are bound by a legal contract to continue spending a certain amount of money every month/quarter/year. Such revenue is highly predictable. SaaS subscriptions and Managed services contracts often fall in this category.

-

Re-occurring revenue - this is revenue that is not contractually secured but the nature of the service makes it difficult for the customers to leave. Metered SaaS services like AWS is a good example: customers are welcome to leave but the nature of the service is such that a customer that migrates their applications to AWS rarely leaves. Professional services -with the right service model- can be in this category. For example, a PS firm that thrives on their knowledge of the customer and the relationships can make themselves indispensable over time; strategy employed by most large consulting firms.

-

Transactional revenue - this is revenue where there is a one-time relationship with the customer, typically an SOW, which runs to the completion of a project. Revenue finishes when the project finishes. The customer may be very happy with the service, but still may never buy from them again.

The type of revenue makes a big difference in predictability. Companies where most revenue is recurring revenue,have some clear benefits. They can grow faster because they do not have to go back to selling every so often. They can count on the revenue and move forward to sell more, and expand. A second, and often ignored, benefit is that knowing their minimum revenue expectation allows them to plan initiatives with higher confidence. They know the amount of cash flow to expect, and can be more forward thinking with their investments. This creates a positive loop: more confidence in revenue leads to more investment in building better services, which leads to even more recurring revenue. ETS founders should strive hard to make their service models such that they can charge recurring revenue – we call this the “bias to make recurring revenue,” a trait every ETS startup should have.

Re-occurring revenue has some of the same benefits as Promised recurring revenue, but the risk of losing this revenue is higher. In our experience, moving revenue from re-ocurring to recurring revenue is typically not a difference in delivery, but rather a different packaging of the services. The same service can be delivered as a DevOps Agile team or as a DevOps as a service subscription. The latter can be a monthly fee. It is worth even giving a discount for a subscription given the benefits.

Project-based revenue is the most risky revenue. The sales team is always busy selling and predictability is low, hence the company always maintains cash reserves in case sales slowdown for a quarter. This can create a downward spiral. Low confidence in future revenue makes the company more risk averse in high and also investing in IP and improving their services. Consequently, they are unable to make their services more suited to charge high quality revenue.

As an ETS founder, understanding the types of revenue and the implication of this is critical. Creating a focus to reduce your revenue risk can benefit your company both in day to day and increasing its Enterprise value.

In the Vixul team, we have multiple CEOs who have made this transition from translation to reoccurring or recurring revenue. We can help founders of ETS startups make this transition successfully. Learn more about Vixul at http://vixul.com

The other articles in our "Demystifying ETS Valuations" series are:

-

Demystifying ETS Valuations Part 4: EBITDA and the rule of 40

-

Demystifying ETS Valuations Part 5: Intelectual Property

-

Demystifying ETS Valuations Part 6: Addressable Market

-

Demystifying ETS Valuations Part 7: Revenue Predictability

-

Demystifying ETS Valuations Part 8: Team Loyalty

-

Demystifying ETS Valuations Part 9: Badges And Accolades

-

Demystifying ETS Valuations Part 10a: Readiness To Scale

-

Demystifying ETS Valuations Part 10a: Readiness To Scale