After the top four value drivers (Growth rate, Revenue, Gross Margin, and EBITDA), we want to...

Demystifying ETS valuation Part 4: EBITDA and The Rule of 40

Amongst the top attributes that drive ETS valuations, EBITDA is right up there with Growth rate, Revenue and Gross Margin. This metric is extremely timely to talk about with the current economic headwinds. The market has started shifting from rewarding "growth at all costs" to rewarding businesses with higher EBITDA (as of writing in June 2022). While profit and EBITDA are not the same, they are often used interchangeably.

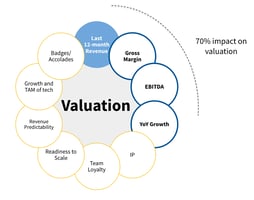

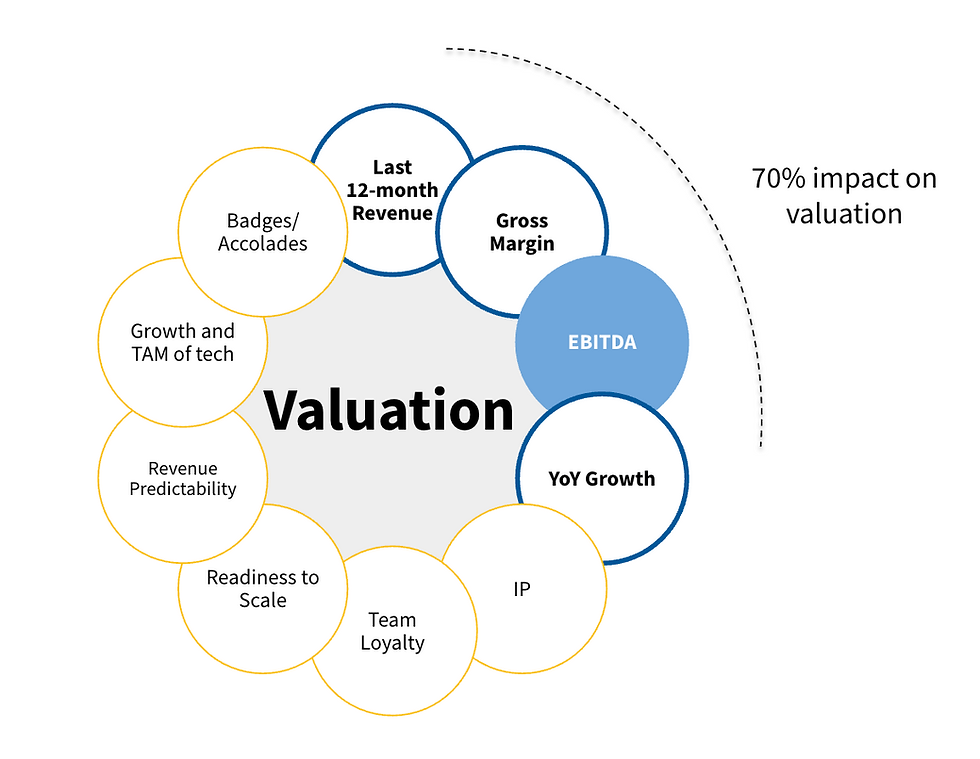

Valuation Drivers

Valuation DriversEBITDA is essentially net income (or earnings) with interest, taxes, depreciation, and amortization added back. EBITDA can be used to analyze and compare profitability among companies and industries, as it eliminates the effects of financing and capital expenditures. You can calculate it as:

EBITDA = Net Income + Taxes + Interest Expense + Depreciation & Amortization

EBITDA is often used in valuation ratios. As we noted in our blog on Growth rate, EBITDA multiples is another way to value companies, rather than using revenue multiples. EBITDA and EBITDA multiples are often used as the primary validation driver in more established, slower growing industries. In ETS, where growth is high, Revenue trumps EBITDA but, EBITDA still holds a lot of importance.

A higher EBITDA indicates to a buyer a clear financial outlook. They can justify the acquisition simply based on the financial value proposition. It also makes the company attractive to a financial buyer who may acquire simply for its cash flow. A negative EBITDA means the business is losing money. An acquirer thus needs to do a deeper analysis on how the business can either become profitable or produce ROI in the long run.

The Rule of 40: Growth vs profitability

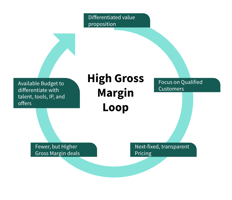

In the blog describing how ETS is different from traditional services, we discuss how growth can be expensive. Thus cost reduces EBITDA. There is thus a trade-off between growth and EBITDA. It needs to be balanced. You can justify a lower EBITDA to an investor/acquirer if the growth rate is high. However, being weak on both of them indicates a poorly managed business with poor operational discipline. In the SaaS world, the balance between profitability and Growth is studied more. They have a rule they call the “Rule of 40.” In a blog from SoftwareEquity, they define it as:

“To put it simply, the Rule of 40 is a standard metric used by private equity investors and strategic buyers to measure the performance of SaaS companies. Measuring the trade-off between profitability and growth, the Rule of 40 asserts SaaS companies should be targeting their growth rate and profit margin to add up to 40% or more. … growth rate is measured by comparing year-over-year changes in ARR or MRR … We prefer EBITDA as the standard of measurement here.”

Thus, the rule of 40 can be represented for an ETS as:

EBITDA + Growth Rate > 40

Consider two scenarios:

Company A is growing 20% YoY revenue growth and has an EBITDA of 15%. This company is not passing the rule of 40 as the sum of the two is 35.

Company B is growing 51% YoY but EBITDA is -10%. This business is passing the rule of 40 as the sum is 41.

Typical ETS businesses have low EBITDA but they make up for it by having high growth. This combination leads to a more attractive acquisition target for an investor looking to grow the business as they can optimize operations to increase EBITDA, and capitalize on the growth to have strong outcomes in the long term.

At Vixul, we help founders understand these different trade-offs and help them make the right decisions. Learn more about how we do it at vixul.com or follow us on LinkedIn.

The other articles in our "Demystifying ETS Valuations" series are:

-

Demystifying ETS Valuations Part 4: EBITDA and the rule of 40

-

Demystifying ETS Valuations Part 5: Intelectual Property

-

Demystifying ETS Valuations Part 6: Addressable Market

-

Demystifying ETS Valuations Part 7: Revenue Predictability

-

Demystifying ETS Valuations Part 8: Team Loyalty

-

Demystifying ETS Valuations Part 9: Badges And Accolades

-

Demystifying ETS Valuations Part 10a: Readiness To Scale

-

Demystifying ETS Valuations Part 10a: Readiness To Scale