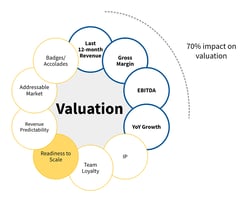

We have already discussed the criticality of the primary valuation drivers like Revenue and Revenue...

Demystifying ETS Valuations Part 1: Growth

And why an ETS founder should target growth rate above all else

|

Would you tell me, please, which way I ought to go from here?” “That depends a good deal on where you want to get to,” said the Cat. “I don’t much care where—” said Alice. “Then it doesn’t matter which way you go,” said the Cat. “—so long as I get somewhere,” Alice added as an explanation. “Oh, you’re sure to do that,” said the Cat, “if you only walk long enough.” - Alice In Wonderland |

|

In our last post we talked about how ETS businesses have the ability to provide life-changing outcomes for its founders. Let's discuss today what makes an ETS business more valuable.

The purpose of this blog is to give ETS founders an understanding of how ETS businesses are valued so that they can understand their destination because knowing the destination is half the journey. We will explain with our own example. In the beginning of Flux7 we were aimless, trying to figure out our purpose and goals. When I shared with a senior advisor that right now we’re learning and having fun, he shared the above quote from Alice In Wonderland with me. While it shouldn’t be the only or even the main purpose, it is a present motivation for every business owner, to provide for them and their family. And in taking the risk of starting a business a startup, the founder expects a life changing outcome. So while every ETS startup will have differences in their vision, services provided, and target market. They will have the same drivers for their valuations which will determine the financial outcome the founders are looking for. At a very high level the figure below shows these drivers.

In this series of posts we will go over these drivers. For your convenience the full list of articles in the series is provided here:

-

Demystifying ETS Valuations Part 1: Growth

-

Demystifying ETS Valuations Part 4: EBITDA and the rule of 40

-

Demystifying ETS Valuations Part 5: Intelectual Property

-

Demystifying ETS Valuations Part 6: Addressable Market

-

Demystifying ETS Valuations Part 7: Revenue Predictability

-

Demystifying ETS Valuations Part 8: Team Loyalty

-

Demystifying ETS Valuations Part 9: Badges And Accolades

-

Demystifying ETS Valuations Part 10a: Readiness To Scale

-

Demystifying ETS Valuations Part 10a: Readiness To Scale

We will start this series by talking about the one that seems most critical, the YoY growth.

Why is YoY Growth a top driver for ETS?

There are two very simple formulas for valuation.

Valuation = EBITDA x EBITDA multiple

Or

Valuation = Last 12 month revenue x Revenue multiple

EBITDA or Earnings Before Interest, Taxes, Depreciation, and Amortization is simply the profit of the company taking out capital investments or any other factors. This measure gives the positive cashflow the company is bringing in. It can vary on the low end to 3x for very small businesses that are running on the hard work of the founders to up to 13x if we’re talking about a business with a respectable sustained growth rate of 20%. This is the most common measure for a company valuation and can be compared against the P/E ratio you see for public companies. For stable companies in the S&P 500 with a strong brand recognitions, stable income, historically have had a P/E of 10.

The EBITDA formula is a very bad measure for a growing company. This is because growth is very expensive and it will eat into your profits. But growth is a lot more valuable because it represents increased profits for perpetuity. So if there is something a company can do to increase growth it should do it, even if it means going into a loss. Which is also responsible for the wide range for the EBITDA multiple because for a growing company you not only have to give credit to the future profits from the growth, but also to the costs of growth incurred.

In this scenario you use a revenue multiple. The revenue reflects the size of the business. You use gross margins to ensure the revenue is healthy and can lead to profitability once the growth starts to stabilize. The multiple varies between 3-5x (even go to 10x) depending on the size and growth rate of the business. The multiplier based on growth represents credit for the future of the business.

To put some idea into what these numbers mean in practice. Consider company A with revenue of $10mm, 30% gross margin on project basis, 10% net margins, 10% year on year growth. This company with 10% net and 10% growth is an extremely healthy company and there can be a strong argument for getting a very high EBITDA multiple of 10x. So by our EBITDA valuation formula the value of the company would be $10mm.

On the other hand consider company B making 5mm revenue, 50% growth, 30% gross margins, and 0% net margin. The company without turning any profit would have a very solid case for a revenue multiple, with even a very conservative number of 2.5x gives it a valuation of 12.5mm. This 25% higher valuation for a company half the size may seem like a lot, but in reality it is reflecting that Company B is going to surpass Company A in two years. And so without going deeper it is obvious why we would want our company to be evaluated on the revenue formula. And the formula used for you depends mostly on your growth number.

The Thesis For ETS

In our post describing ETS we talked about how ETS is in a fast growing market. Well being in a fast growing market means having average execution will put you in the 50% growth rate as you just grow with the market. Having a focused ETS can immediately put you into the territory of an amazingly high growth company. I have to make it clear, the 50% is a mediocre growth number. Most of our veteran founders ran companies with greater than 100% growth rate and won awards for their rapid growth. But this is the thesis of ETS. You put yourself in a rapidly growing market, Focus on your niche, and win customers.

A word on cost of growth: I talked a bit about the cost of growth. There needs to be something powering your growth. You have to build your salesforce and it will take them some time to close business. You’ll hire engineers and you’ll need to train them to your processes and standards before they are fully productive. We described this operating model in another blog. There are also going to be many failed experiments you’ll have to try to grow. You’ll need to try a certain number of experiments to hit your growth targets. In addition the larger the scale at which you are growing, the more you have to try low expected value experiments. So growth will be hard. It will take away a lot of your resources and force you to run a very tight ship.

The hardest part of growth though is the founders have almost the entirety of their net worth tied to this number which is ridiculously difficult to maintain. So the one thing they cannot afford to do is let this number drop. It may seem that you will keep doing more of what is working today and you will have a fast growing business but this is not true. There are several points of inflection in an ETS journey where the business has to re-invent itself to be ready for the next stage of growth. We call each of these a Chasm (we will write more about the chasms in the future blogs).

The Vixul Dream

As founders of Flux7 we knew about the importance of growth. And it was a constant stressor. We had to do the hard work of building a high growth business, while we dealt with the chasms. We also recognize that we left a lot of money on the table because we struggled with the chasms and this took a hit to our growth rate. Our slowest growth year was when we crossed the Chasm #2 (see Vixul.com) in 2017. We weren’t bad, still being included in Inc 5000 and Austin Fast 50. But that is more a testament to the size of the opportunity and the profits to be made from aligning yourself. We made it through the chasms, but in hindsight we wish we had raised our hand and gotten help.

The caveat in the last paragraph is “raised our hand” but where? There didn’t exist a community where we could have gotten help. Some of the most pointed advice we got was from our competitors who were ahead of us but there was a limit to how much help we could get from them. We also leaned on the SaaS founders, read a lot of books on SaaS businesses and try to retrofit the advice to our business. We learned a lot, got our life changing outcome in six years, but we also missed some opportunities. We could have done it faster, better, and with less stress with more guidance and help. Well, with Vixul we are solving exactly that for our upcoming ETS founders. We are creating a place where you can raise your hand. So you don’t have to cross those chasms by trial and error.

Learn more details about Vixul and our offerings on our website.

The other articles in our "Demystifying ETS Valuations" series are:

-

Demystifying ETS Valuations Part 1: Growth

-

Demystifying ETS Valuations Part 4: EBITDA and the rule of 40

-

Demystifying ETS Valuations Part 5: Intelectual Property

-

Demystifying ETS Valuations Part 6: Addressable Market

-

Demystifying ETS Valuations Part 7: Revenue Predictability

-

Demystifying ETS Valuations Part 8: Team Loyalty

-

Demystifying ETS Valuations Part 9: Badges And Accolades

-

Demystifying ETS Valuations Part 10a: Readiness To Scale

-

Demystifying ETS Valuations Part 10a: Readiness To Scale