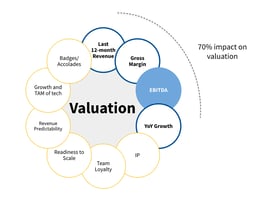

Amongst the top attributes that drive ETS valuations, EBITDA is right up there with Growth rate,...

Demystifying ETS valuation Part 5: Intellectual Property

After the top four value drivers (Growth rate, Revenue, Gross Margin, and EBITDA), we want to discuss the role Intellectual Property (IP) plays in ETS valuations. IP is any asset a business develops to help their customers. It is either delivered to the customer directly as an asset, or used to improve the customer experience. IP typically will help by standardizing, streamlining, or automating certain parts of the business. IP is a tangible asset and very valuable to an acquirer/investor.

Valuation Drivers

Valuation DriversIn an ETS business, IP is often developed by accident. For example, an engineer is tired of doing the same task for multiple customers every day so she writes a script to do it. This script is now IP. However, this script is just a personal efficiency tool. While it is helping the business already, its value is low because if that engineer leaves, this IP will just fizzle. It is possible to make it more valuable with simple steps: move the script to a central repository of code, make the script more robust and flexible, develop documentation, train all engineers to use it, and add it to Standard Operating Procedure (SOPs). The same script is now far more valuable and will get credited as IP at the time of valuation. Important to add that in rare cases, the business may get it patented and then it becomes even more valuable and defensible.

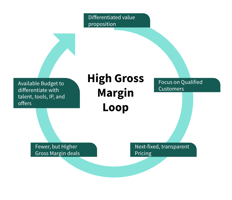

When it comes to IP, ETS founders often fall into one of the two extremes. They either put no focus on IP development, and thus any such IP that even gets developed as a byproduct is never matured. Or, the founders become very IP-centric and proactively invest in IP development. It is common for ETS founders to over invest in IP without a strategy to monetize it. To really see its impact on your business and valuation, it is important to produce IP that has a higher ROI to the business and contributes directly to the company’s vision & goals.

It is also important to note that IP is not just technical. Anything that you have developed as an asset and helps in the business is IP. It includes your website, your blogs, your case studies, your sales decks, your finance processes, your interview checklists, onboarding process etc.

Just having IP is not enough, it is important to maintain it as a portfolio of assets, often called an IP Portfolio. This is because having a portfolio is how you can get value out of the IP at the time of valuation. A strong IP portfolio can increase the multiples for your valuation – can be as high 20%-30%.

Three steps ETS founders can take to leverage IP for increasing valuations:

-

Cut down IP waste. IP often gets wasted as it gets thrown away after use. Educate yourself and your team on what is IP, and always look for assets that are IP.

-

Invest in IP systematically. Not all IP is created equal. Some shall be one time use and best left to waste. Others need to be invested in and matured to maximize its potential. Once you know all the IP you have and have a process to document what you are producing, review the list and make a decision on each IP if it should be matured, maintained, or culled. Tip: Most IP should be culled but having it on the list, marked as culled, still is more valuable than it never surfacing to you because it gives you the ability to change your strategy in the future if the business environment changes.

-

Maintain an IP Portfolio. The IP Portfolio is the list description of the IP assets a company owns.

A really good one will explain for each IP its value to the business, its maturity level, its form, its visibility, and its future strategy.

IP management is one of key topics we discuss in the Vixul Maturity Framework. Learn more about how you can get help from our team at vixul.com.

The other articles in our "Demystifying ETS Valuations" series are:

-

Demystifying ETS Valuations Part 4: EBITDA and the rule of 40

-

Demystifying ETS Valuations Part 5: Intelectual Property

-

Demystifying ETS Valuations Part 6: Addressable Market

-

Demystifying ETS Valuations Part 7: Revenue Predictability

-

Demystifying ETS Valuations Part 8: Team Loyalty

-

Demystifying ETS Valuations Part 9: Badges And Accolades

-

Demystifying ETS Valuations Part 10a: Readiness To Scale

-

Demystifying ETS Valuations Part 10a: Readiness To Scale